India is one of the world’s largest suppliers of natural stone, especially granite. Every year, thousands of containers are shipped from India to major global markets like the USA, Canada, Europe, the Middle East, and Australia. With a massive supply chain that includes quarries, factories, distributors, and global logistics networks, Indian granite has become a preferred material for kitchen countertops, flooring, wall cladding, and premium architectural projects.

If you’re planning to start exporting granite or are a buyer looking to understand the compliance process, this guide breaks down all the documents required for granite export from India, along with insights on how marble and granite exporters in India handle international shipments efficiently.

Why Proper Documentation Matters in Granite Export

Granite export involves multiple checkpoints customs clearance, port authorities, quality checks, insurance validation, shipping procedures, and international compliance rules.

Proper documentation ensures:

- Smooth clearance at Indian ports

- Faster acceptance at destination ports

- No delays, penalties, or demurrage

- Transparent transactions between the exporter and the importer

- Global trade compliance

Experienced granite exporters from India follow strict document protocols to ensure every shipment whether slabs, tiles, blocks, or cut-to-size items arrives safely and legally at the buyer’s location.

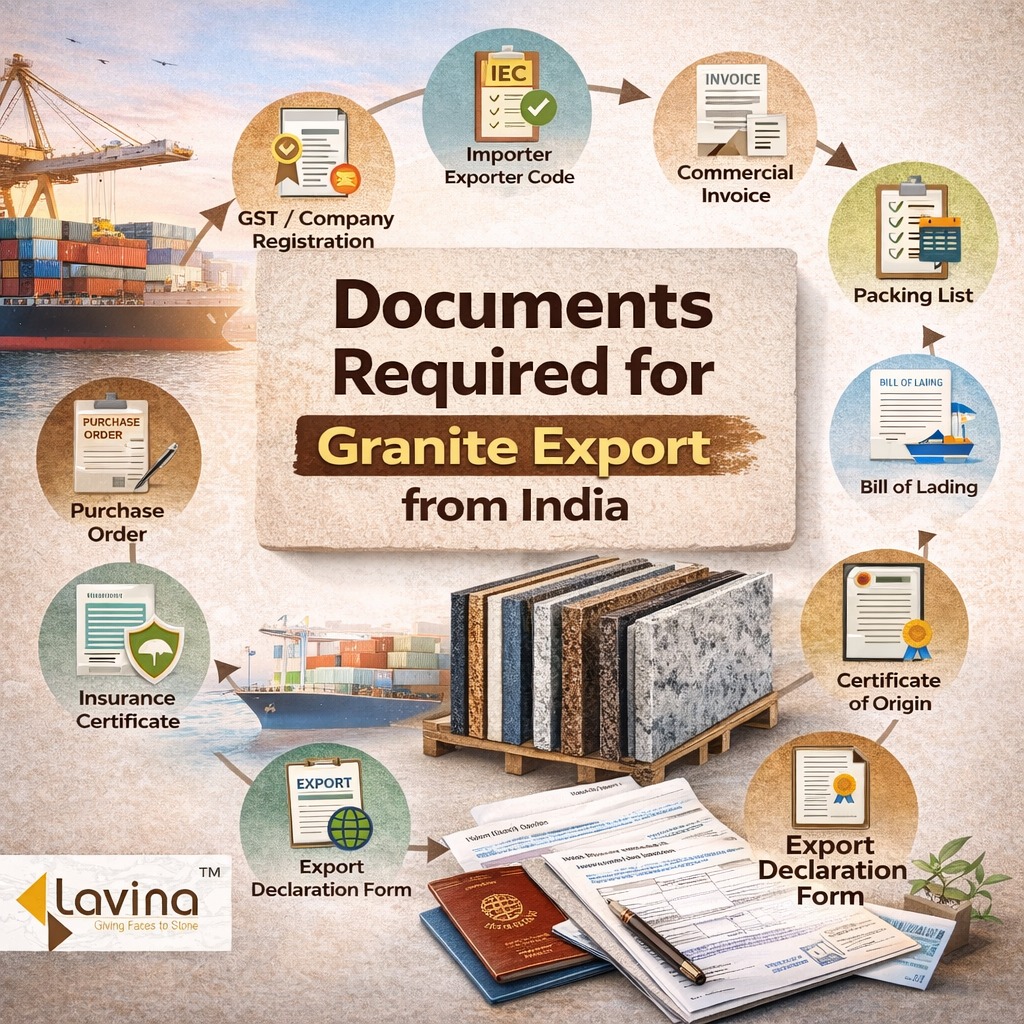

Key Documents Required for Granite Export from India

Below is the complete list of documents every granite stone exporter India must prepare before shipping to the international market:

1. IEC – Importer Exporter Code

The first and most essential requirement is the IEC (Importer Exporter Code) issued by DGFT.

Why it’s needed:

- Acts as the exporter’s global identity

- Required at customs, port, and shipping company

- Mandatory for foreign currency remittance

Every serious granite exporters in India company must have an active IEC before starting operations.

2. GST Registration Certificate

Since granite is a taxable product, the exporter must hold a valid GST registration.

Why it matters:

- Needed for issuing tax invoices

- Required for claiming GST benefits

- Important for audit and compliance

Almost all marble and granite exporters in India operate under GST to maintain transparency.

3. Company Registration Documents

Exporting requires a legally registered business, such as:

- Proprietorship

- Partnership firm

- LLP

- Private Limited Company

These documents help verify ownership and authenticity during customs procedures.

4. Purchase Order (PO) or Sales Contract

A valid sales agreement between the exporter and the foreign buyer is crucial.

It includes:

- Product details

- Quantity

- Price

- Incoterms (FOB, CIF, CFR, etc.)

- Delivery timeline

- Payment terms

A clear PO reduces disputes and ensures smooth transactions.

5. Commercial Invoice

The commercial invoice is one of the most important export documents.

It includes:

- Exporter and buyer details

- Description of granite (colour, finish, size)

- HS Code

- Quantity (sq ft, sq m, or slabs count)

- Unit price

- Total invoice value

- Shipping terms

- Payment mode

Customs officials use this invoice to calculate duties (if applicable) and verify shipment accuracy.

6. Packing List

Each shipment must include a detailed packing list specifying:

- Type of packaging (wooden crates, bundles, pallets)

- Slab numbers, thickness, and sizes

- Total weight (gross & net)

- Number of crates

- Container number

- Marks & labels

Since granite is a heavy and fragile product, a proper packing list ensures safety and transparency during handling.

7. Certificate of Origin

A Certificate of Origin (CoO) proves that the granite was mined and processed in India.

It is issued by:

- Chamber of Commerce

- Export Promotion Council

Many countries require this document to determine duty exemptions or import restrictions.

8. Shipping Bill / Export Bill

This is the official customs document generated by ICEGATE when goods are cleared for export.

It includes:

- Product details

- Invoice value

- Exporter & importer information

- Duty status

- Shipping port information

Without the shipping bill, the container cannot leave the country.

9. Export Declaration Form (EDF)

This form must be submitted to customs to declare:

- Value of goods

- Purpose of export

- Mode of payment

It ensures foreign currency earnings are legally reflected in India.

10. Bill of Lading (BL)

Issued by the shipping company, the Bill of Lading is the transport document that acts as:

- A receipt of goods

- Proof of shipment

- Title of goods (used for claiming ownership at the destination port)

Granite exporters typically choose:

- House Bill of Lading (HBL) – if using freight forwarders

- Master Bill of Lading (MBL) – if shipping directly

For the importer, BL is needed for customs clearance in their country.

11. Insurance Certificate

Shipping granite involves risks such as:

- Breakage

- Moisture damage

- Accidents

- Container loss

- Port mishandling

Exporters often take marine cargo insurance under CIF terms to protect the buyer’s interests.

12. Quality Certificates

Many overseas buyers demand quality reports such as:

- Material inspection report

- Thickness and polish grade

- Moisture content

- Surface finish certificate

- Colour consistency check

Experienced granite exporters from India provide detailed quality documentation to build trust.

13. Phytosanitary Certificate

If the granite is packed in wooden crates, the wood must be fumigated and certified to prevent pests.

This is mandatory for countries like the USA, Australia, and Europe.

Additional Supporting Documents

Depending on the destination country and buyer requirements, exporters may also need:

- Bank Realization Certificate (BRC)

- Export value declaration

- ARE-1 form for excise clearance

- Weight certificate

- Loading list

- Cargo Inspection Report

- Certificate of Measurement

How Professional Exporters Handle the Documentation Process

Top marble and granite exporters in India such as large manufacturing houses and quarry-backed suppliers follow a systemized process:

- Dedicated documentation teams

- Digital invoice and packing-generation systems

- Pre-approved shipping formats

- Strong relationships with freight forwarders

- Compliance-based export procedures

This makes the entire export journey smooth for global buyers.

Role of Granite Exporters in Ensuring Smooth USA Shipments

The USA is one of the largest importers of Indian granite.

To match American standards, top exporters ensure:

- HD images + video inspections of slabs

- Proper fumigated packaging

- Insurance for full container load (FCL)

- Complete documentation with HS codes

- CIF delivery support

- Transparent communication during transit

A professionally managed granite stone exporter India ensures buyers face no difficulties at US ports during customs clearance.

Final Thoughts

Exporting granite from India requires accuracy, documentation, and compliance. With the right exporter Lavina granite, every shipment from quarry to container moves smoothly. Whether you’re dealing with granite exporters in India or large-scale marble and granite exporters in India, understanding these documents gives you full control over your international trade processes.

Proper documentation is not just paperwork it is the backbone of seamless granite export. When handled correctly, it builds trust, ensures quality, and strengthens long-term business relationships across continents.